Are input costs recoverable in today's markets? Hints are emerging which may answer this question in some of the agricultural investment and commodity articles below.

INVESTMENT: Companies on the Move

COMMODITIES:

INVESTMENT: Companies on the Move

Converted Organics Fertilizers Sprout Super Spud Results in Idaho - Converted Organics Inc.(COIN) announced today that growers are reporting remarkably positive results from using Converted Organics(TM) LC and Converted Organics(TM) GP fertilizers. Throughout Eastern Idaho, potato growers using the product are reporting significant increases in both yields and in disease suppression.

Seed giant Limagrain arrives in Fort Collins - Group Limagrain, the biggest producer of crop seeds and crop research in Europe, has opened a subsidiary in Colorado with an office in Fort Collins. Limagrain Cereal Seeds is the first American office for Group Limagrain. The company will focus on wheat research and market its seeds under the LG brand.

JBS USA buys Greeley headquarters building - JBS USA, the American subsidiary of Brazil-based JBS S.A. meat company, has purchased its headquarters building in the Promontory development in west Greeley.

Global Seeds Market to Reach US$47 Billion by 2015, According to a New Report by Global Industry Analysts, Inc. - The global seed market has undergone rapid transformation in recent years with the advent of biotechnology in agriculture. Genetically Modified (GM) seeds offer economic advantages to farmers, and are sold at a premium in relation to conventional seeds.

Food Inflation Coming? - Food, like energy, is an area where compression of margins is very limited: Raw material prices are largely passed through to the consumer.

Seed giant Limagrain arrives in Fort Collins - Group Limagrain, the biggest producer of crop seeds and crop research in Europe, has opened a subsidiary in Colorado with an office in Fort Collins. Limagrain Cereal Seeds is the first American office for Group Limagrain. The company will focus on wheat research and market its seeds under the LG brand.

JBS USA buys Greeley headquarters building - JBS USA, the American subsidiary of Brazil-based JBS S.A. meat company, has purchased its headquarters building in the Promontory development in west Greeley.

Global Seeds Market to Reach US$47 Billion by 2015, According to a New Report by Global Industry Analysts, Inc. - The global seed market has undergone rapid transformation in recent years with the advent of biotechnology in agriculture. Genetically Modified (GM) seeds offer economic advantages to farmers, and are sold at a premium in relation to conventional seeds.

Food Inflation Coming? - Food, like energy, is an area where compression of margins is very limited: Raw material prices are largely passed through to the consumer.

COMMODITIES:

Iron Ore, Coal Prices Squeezing Posco Margins - Posco (PKX), one of the world's biggest steel companies, sold 24% more of its product into Asia's steel-hungry factories last quarter, but its profits still sank 8% as costs climbed faster. The Korea-based giant confessed that its operating margins sank 4 full percentage points between July and September because strong global competition made it impossible to pass on rising iron ore and coal prices to its customers. (Kalpa's note: I included this steel story to serve as an example of what I expect to happen to grain commodities.)

When High Commodity Prices Come Back to Haunt Us - The corporate profit margin is in danger of collapse as an unintentional result of the Fed’s QE program. Given that commodity prices move well ahead of any improvement in wealth growth, consumption, or employment, the production cost is rising faster than the retail price. (Kalpa's note: Are you getting the picture?)

Demand surge to keep sugar prices high for years - World sugar prices are set to remain at elevated levels for years, to ensure producing countries – and notably Brazil – ramp up output to meet demand growth of more than 50% over the next two decades, Czarnikow said in a report.

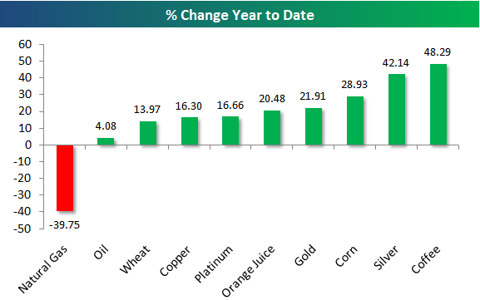

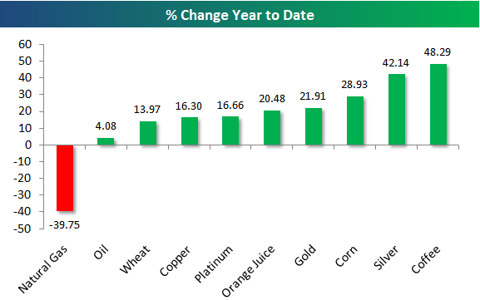

Bespoke's Commodity Snapshot (10/26/10) - Most commodities are currently trading near the top of their trading ranges....Coffee and copper are currently the most overbought of the commodities shown.

When High Commodity Prices Come Back to Haunt Us - The corporate profit margin is in danger of collapse as an unintentional result of the Fed’s QE program. Given that commodity prices move well ahead of any improvement in wealth growth, consumption, or employment, the production cost is rising faster than the retail price. (Kalpa's note: Are you getting the picture?)

Demand surge to keep sugar prices high for years - World sugar prices are set to remain at elevated levels for years, to ensure producing countries – and notably Brazil – ramp up output to meet demand growth of more than 50% over the next two decades, Czarnikow said in a report.

Bespoke's Commodity Snapshot (10/26/10) - Most commodities are currently trading near the top of their trading ranges....Coffee and copper are currently the most overbought of the commodities shown.